The Sound For

Growing Business

Trusted by 60 Lakh+ Merchants Get Your kitzone Soundbox

Kitzone Soundbox is a game-changer for Payment experience! Kitzone soundbox delivers exceptional audio payment alert , even at high volumes.

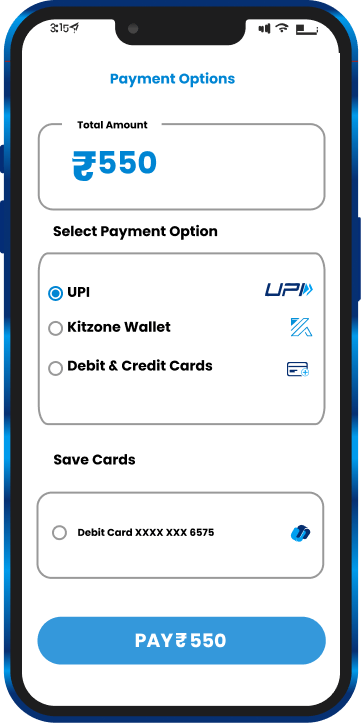

Customer scans Merchant QR using any UPI App

Add Paying Amount to Application

Payment Success Sound alert on soundbox

Payment immediately impact on your bank account

Upto 100% Cashback on Monthly Rental

Avoid Payment Fraud

Available in multiple Languages

Kitzone Sound supports payments on Kitzone QR codes through multiple payment methods -

On-us transactions are typically faster and less expensive than transactions that involve external networks, such as wire transfers or payments to accounts at other banks.

Off-us transactions typically involve additional processing steps, such as routing through payment networks (e.g., Visa, Mastercard, or ACH), which can lead to:

In contrast, on-us transactions occur entirely within the same bank, making them generally faster and less expensive.

using their Aadhaar number and biometric authentication (fingerprint or iris scan).

AEPS aims to increase financial accessibility and inclusion, especially in rural and underserved areas, by leveraging the widespread adoption of Aadhaar. It provides a convenient, secure, and efficient way to make transactions, reducing reliance on physical cards or accounts.